Complete

Digital Excellence

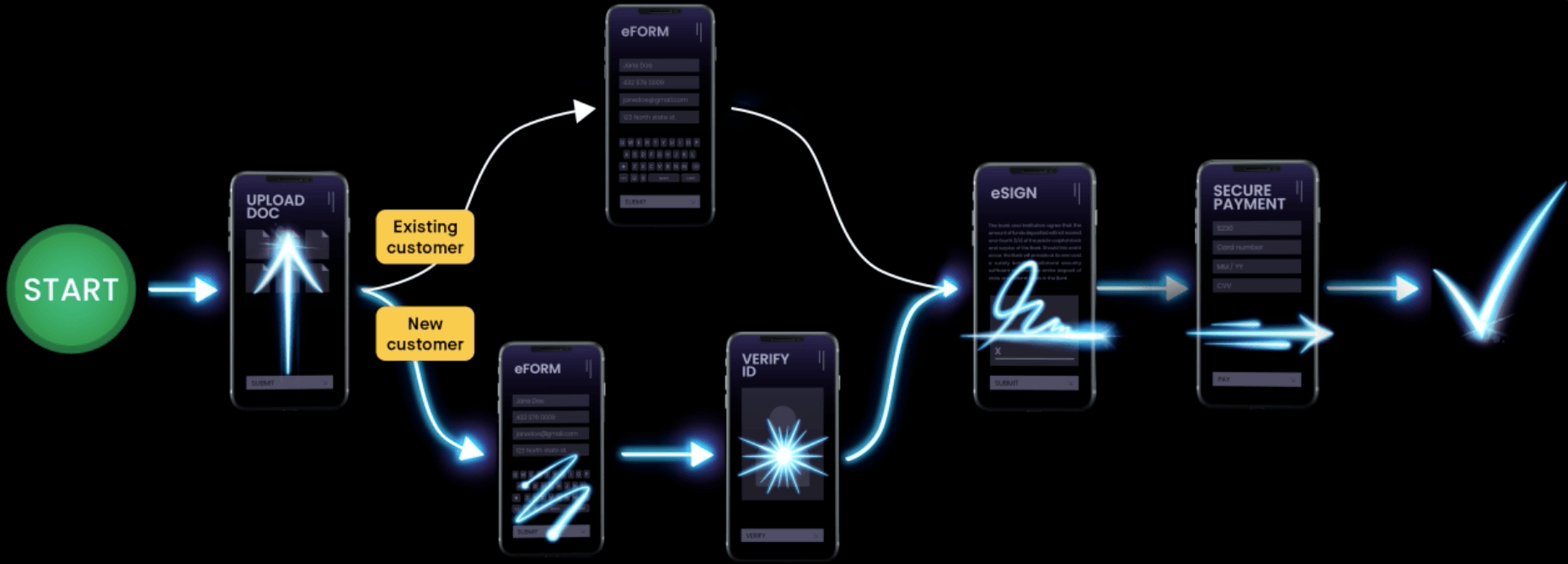

Digitize and automate your customer facing processes with our all-in-one platform featuring identity verification, e-Signatures, and more, all powered by AI-driven automated workflows and intelligent document processing.

The Digital Completion Cloud

Digitally Complete Entire Customer Journeys

Put an end to long and painful customer journeys.

From eSigning forms, verifying ID, adding supporting docs, intelligent document processing and more, customers breeze through the process, freeing up your agents to sell more, cut costs, and make your business more efficient.

Drag-and-Drop Workflows That

Really Flow

Design your own automated no-code workflow no matter what business logic’s behind it. So instead of chasing customers, you’re crushing targets, and cutting IT costs.

Consumers,

this one’s for you

Customers hate being bounced from phone call to inbox to branch. It’s time to deliver a sleek, mobile experience that your customers start and finish from their phones, including the automatic validation and extraction of relevant data from important documents.

Built for any business

“A user-friendly way to handle the heavy lifting of getting your contracts sorted!”

Light Up Your Mind

Why Your 1st Generation eSignature Solution Isn’t Working For You Anymore

Technological advances over the last few years have led to the development of much more…

Read More4 Reasons Your eSignature Completion Rate Is Low & How to Fix It

The electronic signature (eSignature) has facilitated business operations for almost two decades.

Read MoreeSignature Solutions: The Complete Guide

eSignatures arose out of the need to collect consent in a more efficient and digital-friendly…

Read More"Great tool to expedite customer service"

The most helpful thing about Lightico is the fast turnaround time, The upside is that you are giving your customer an easy way to respond quickly and efficiently. Lightico has cut work and waiting time as you can send customer forms via text and get them back quickly, very convenient for both parties."Great Service and Product"

I love the fact that I can send or request documents from a customer and it is easy to get the documents back in a secured site via text message. Our company switched from Docusign to Lightico, as Lightico is easier and more convenient than Docusign, as the customer can choose between receiving a text message or an email.Start Completing at the Speed of Lightico

Instant eSignatures, IDV, Document Collection & More